Diversified financial services firm Britam is reinvesting its profits for the financial year ending December 31, 2023, to continue to fuel its ambitious five-year business strategy.

In its message to shareholders during the firm’s 28th Annual General Meeting (AGM) the Nairobi Securities Exchange (NSE) listed firm eyes entry into the lucrative Democratic Republic of Congo (DRC) market as it seeks to diversify and expand beyond its current seven African countries.

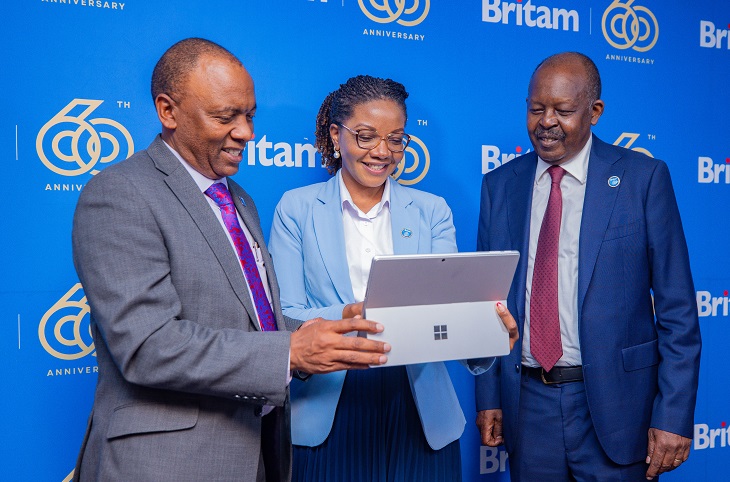

“Entry into DRC is one of the activities that the Board has taken quite seriously. We are looking at the market and have already identified some opportunities,” said Britam Group Managing Director and CEO Tom Gitogo while speaking at the AGM.

Britam is in the fourth year of its 2021-2025 strategic plan – which is right on track as Britam’s profits nearly doubled in 2023 as compared to the previous year.

Mr Gitogo hinted at a possible future dividend payout for shareholders in light of the encouraging financial results in the last 3 years.

“Our ambitious strategy for growth requires a certain level of funding, hence this decision to postpone dividend payouts,” said Gitogo.

Britam’s performance in 2023 was robust, with a profit before tax of Ksh 4.82 billion, a 65% increase from Ksh 2.92 billion in 2022. This improvement is attributed to growth in both insurance and investment activities.

The Group’s total insurance revenue and fund management fees were up 40 percent to Kshs 37.1 billion from Kshs 26.4 billion in 2022. Of this amount the international businesses generated Kshs 10.6 billion, accounting for 29 percent of the total insurance business revenue. The international businesses remain a key pillar of the Group’s geographical diversification strategy.

In the year ended 2023, Britam’s balance sheet also strengthened, with total equity rising to Ksh 25.69 billion from Ksh 22.16 billion in the previous year.

Britam Group Chairman Kuria Muchiru further expressed optimism about the company’s future. “We have made notable strides in our five-year plan, and we are confident that this strategy will achieve and exceed our target expectations,” Mr. Muchiru said. “Our focus is now scaling up the customer-centric transformation to increase customer numbers and revenue growth.”

The company’s investment in Housing Finance Group (HF Group PLC), where it holds a 48.2% share, continues to show promise. In 2023, Britam reported a share of profit of Ksh 187 million, up from Ksh 95 million in 2022.

“The investment in HF Group is maintaining its recovery momentum and has recorded good results,” noted Mr. Muchiru.

In line with its sustainability commitment, Britam recently unveiled its inaugural 2023 Sustainability Report highlighting its commitment to environmental stewardship, social responsibility, and ethical business practices.

“The report details our 2023 achievements in reducing environmental impact, improving healthcare access, creating climate-resilient insurance solutions and maintaining ethical standards. Britam is dedicated to ongoing improvement through stakeholder engagement, exploring renewable energy, setting environmental baselines and using technology for efficiency. Financial inclusion remains a key focus, with innovative products and partnerships enhancing accessibility,” said the Group Chairman.

Britam, which has been in the market for almost 60 years, has maintained a stellar recognition in brand performance. The company’s brand value surged by 35% to Ksh3.8 billion, earning it the title of the third strongest Kenyan brand and 6th fastest growing Kenyan brand of 2024, according to Brand Finance. It was also one of only three brands with AAA+ ranking, a rating that is reserved for brands that demonstrate exceptional strength and effectiveness in their operations and marketing strategies.

Looking ahead, Britam remains cautiously optimistic about the operating environment and business performance in 2024, despite local and global economic uncertainties. “We have built resilience over time, and we are optimistic about a favorable operating environment,” Mr. Muchiru said as he concluded the AGM.

Related Content: Britam Now Chooses Environment And Financial Inclusion As Main Focus