In February 2021, Acorn, the developers behind the Qwetu Student Residences, the group’s flagship brand for quality hostels, listed two Real Estate Investment Trusts (REITs) on the Nairobi Securities Exchange, the first such offering of its kind. Acorn listed an Income (I) REIT and a (D) Development REIT.

How have the REITs performed over the last four years? The answer lies in the numbers, so let us dig in.

ASA I-REIT

First, we will examine the I-REIT, dubbed the Acorn Student Accommodation Income Real Estate Investment Trust (ASA I-REIT), which houses Acorn’s portfolio of hostels, also known as purpose-built student accommodation (PBSAs), in financial terms.

Examining the 2024 numbers, it is evident that Acorn’s Qwetu PBSA model is tried, tested, and certified A+. The ASA I-REIT 2024 Annual Report shows that investment delivered stellar results across the board, from profitability to sustainability.

Let’s crunch the numbers.

In 2024, the ASA I-REIT achieved its best-ever financial and operational results, surpassing the billion-shilling mark. This strong performance was driven by expanded capacity, higher rents, consistently high occupancy rates, and effective cost management.

Rental income stood at KES 1.1 billion, a nearly 50% year-on-year increase from KES 722 million posted in 2023, while net profits rose by over 40% to KES 555.6 million from KES 396 million posted over a similar period.

Related Content: From Crisis To Qwetu, Where It All Began

Rents were also shielded from the ravaging effects of inflation by the 7.1% portfolio-wide rental escalation that was effected in April 2024.

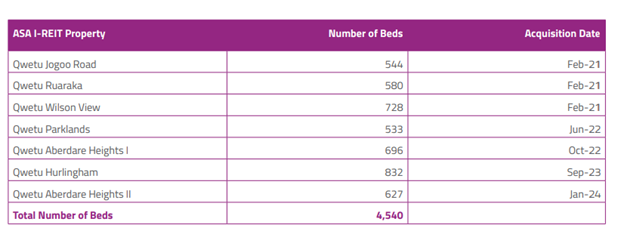

Looking at occupancy levels, the 7 ASA I-REIT properties registered a strong performance with occupancy holding steady at an annual average of 87%.

While on capacity, the 7 properties now have a combined bed capacity of 4,540. This was achieved after the REIT acquired the 627-bed Qwetu Aberdare Heights II property in January 2024. Overall, the REIT has expanded its capacity by an impressive 8.3 times since its first property, Qwetu Jogoo Road, debuted with 544 beds in 2017.

Additionally, Acorn significantly enhanced its ESG performance, marked by strong ratings and notable reductions in energy and water intensity. The company also boosted renewable energy adoption, decreased carbon emissions, improved waste diversion, and ensured all new projects met IFC EDGE sustainability standards.

Sustainability

Looking ahead, Acorn’s management has implied a two-pronged approach to keep revenues on the ante.

First, Acorn is expanding its target tenant base to include TVET students, supplementing the primary demographic of university students.

Data shows there are 70 universities in Kenya, but a whopping 2,577 TVET institutions. This has a key advantage. For example, in Q3 2024, there was a fall in occupancy rates as some universities were on a break within the period. Diversifying the student mix can cushion rental income flow from such disruptions.

Second, the management has cited increasing business-to-business (B2B) partnerships. Currently, the ASA I-REIT has partnerships with the Mastercard Foundation, M-PESA Foundation, Aga Khan University Hospital, and HEVA fund, which sponsor student accommodation at its properties. These partnerships provide steady occupancy for the properties, further cementing the ASA I-REIT’s ability to maintain high occupancy rates, as evidenced by the 87% in 2024.

In conclusion, the ASA I-REIT has consistently demonstrated high occupancy and stable, inflation-protected income. Acorn’s Qwetu PBSA model is tried, tested, and A+ certified.

Related Content: The Qwetu REITs Journey That Kenyans Are Investing In From Ksh 5,000