It is your actions that turn your business journey into success. The success or the failure of any given business is 90 percent dependent on the actions we take.

The very first step towards running a successful business is to identify a bank account that fits your business needs. Not every bank has a product that rhymes with every business.

Shopping for a bank account is as good as shopping for products and services for your business. Have a series of banks, compare the bank accounts they have and see whether they fall within what your business needs.

One of the banks that perhaps has the best products in terms of bank accounts for businesses is the Co-operative Bank of Kenya. Today, we unpack their bank account; Haba Haba Account:

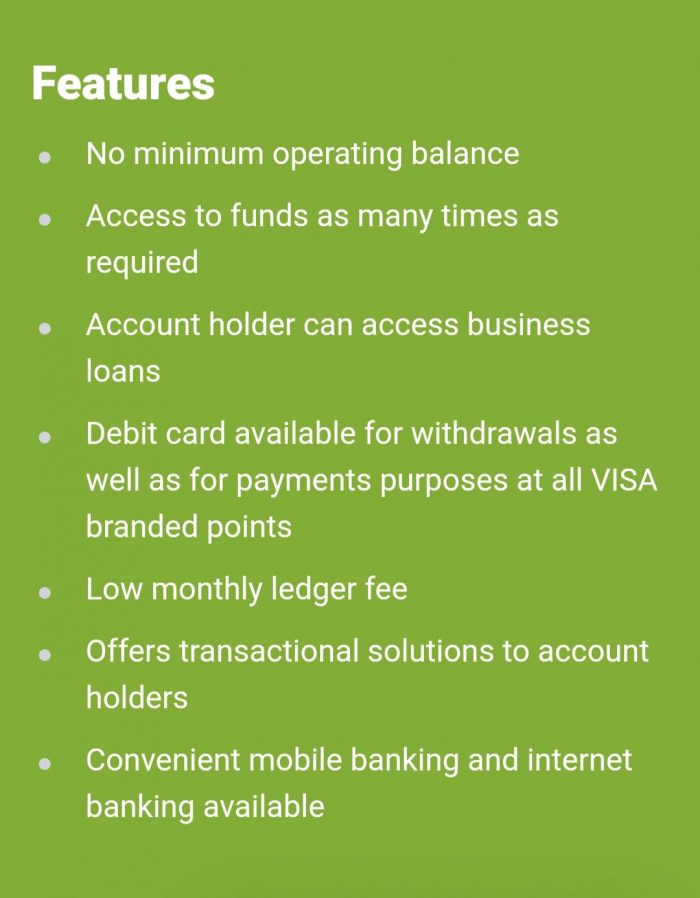

Haba Haba Account Features

No minimum operating balance

Access to funds as many times as required

The account holders can access business loans by the Co-operative Bank of Kenya at any time

Low monthly ledger fees

Co-operative Bank of Kenya Haba Haba Account Features

Requirements for the Haba Haba Account

To open the Haba Haba Account by Co-operative Bank of Kenya, one needs only three things:

A copy of the National ID

Ksh 550 as opening balance

A copy of the KRA PIN

Why does your business need a bank account?

With the advances in technology, many people would say that having a bank account is not as important, but it is. At the peak of the Covid-19 pandemic, businesses with bank accounts managed to survive as compared to those without.

Having a bank account as a business gives you a “friend” in the bank. This means that you have an upper hand in approaching your bank for a loan or assistance over someone without an account.

Having an account helps you track the performance of your business in terms of cash flow.