Nobody can run away from retirement. It is as inevitable as death. It comes, no matter what. And when it comes, it gets two kinds of people; those who prepared for it and those who thought it will never come, and, therefore, never prepared for it.

The truth is, most people don’t think about retirement or spend any time thinking about what will happen when they stop working. For this reason, many people are unable to retire when they’d like to because they were unable to plan for their retirement.

Many things come with retirement, one of them being health issues and complications. During the prime ages of working, one is often more healthy and less prone to health complications than when they retire. So many complications come with old age.

Experts say that many people tend to spend more on health when they retire than when they were still working. In old age, staying healthy becomes a pivotal goal, one that could mean more visits to the doctor for preventive tests and routine diagnostics. And with people living longer today than a few decades back, the cost of healthcare will become one of the biggest expenses you will face in retirement.

Given that old age has more risks to your health compared to now, what can you do to evade those stressful days that are suddenly coming? Plan. Start saving. Take a healthy pension plan that will take care of all your health needs when the dark days finally land.

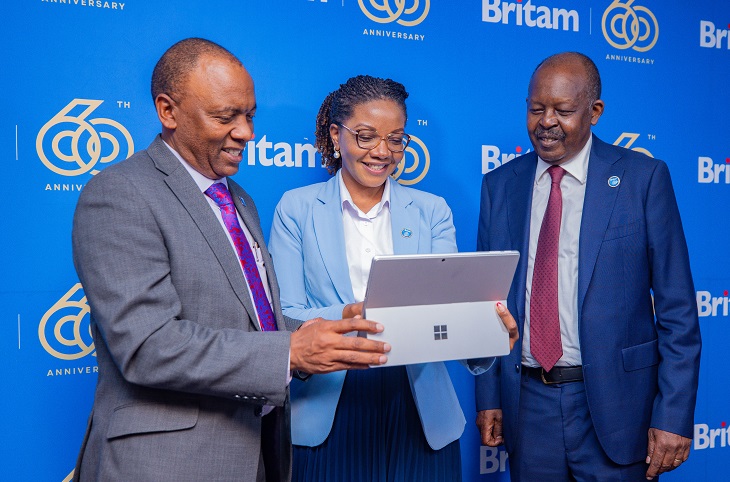

The Britam Afya Pension plan is an example of what everyone needs as they head into retirement. The Afya Pension Plan enables customers to save towards purchasing medical insurance after retirement through Pension schemes, going a long way in assisting them plan for their health-related retirement expenses.

The plan offers flexibility in that one can save during their working years and later access quality healthcare when they need to after retirement.

Britam Afya Pension offers a wide range of benefits including the flexibility to transfer their funds at will in the event of a change of employment, tax efficiencies, and superior investment returns.

Upon retirement, a member is free to choose the type of medical coverage they need to purchase. As a member, for instance, you can a portion of the whole fund to a registered insurance company for the purchase of a medical insurance cover or provision of medical benefits within the scheme and/or medical fund per the scheme or fund provisions.

Within the scheme, you can get Milele Health Plan which is an inpatient medical cover with no age limit. It allows anyone above 70 years to join and enjoy in-patient and out-patient medical benefits, critical illnesses cover, personal accident cover, overseas treatment, professional consultation in stress management, nutrition and health, annual wellness checks, and family planning benefits, among others.